Articles

<< back to all ArticlesBy-Law Newsletter: Data Centres

What Are They and How Will They be Assessed for Municipal Property Taxes?

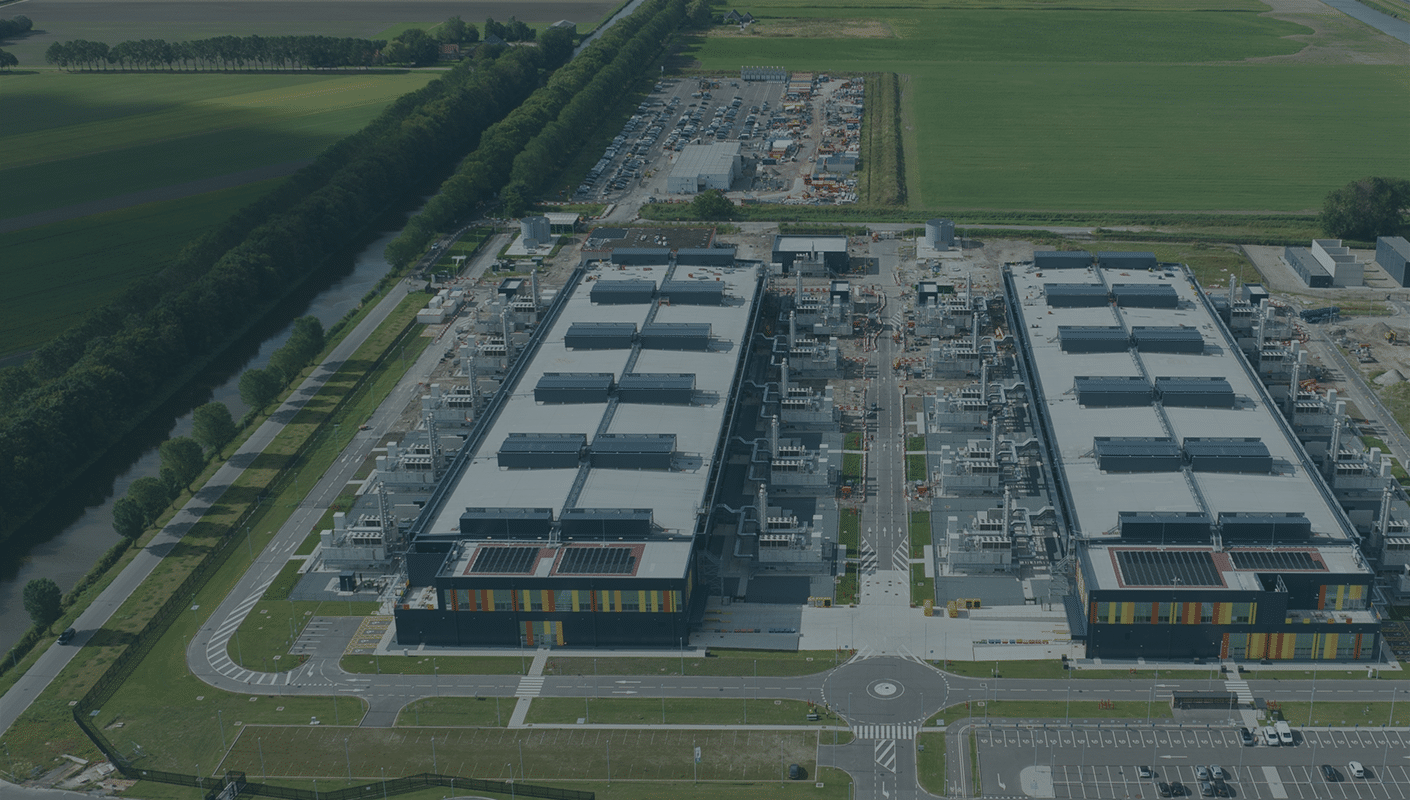

A data centre is a facility that houses computer systems and associated components, such as storage and networking equipment used for processing, storing and managing data.

The Province has developed an Artificial Intelligence Data Centre Strategy to pursue investment and digital innovation. A recent article published online by the CBC, says that the Alberta Electric System Operator (“AESO”) has received 231 data centre applications. Applications to the AESO are required for several reasons. Some proposed projects want to draw power from the existing power grid and other projects are planning to construct their own power generation infrastructure.

Proposed data centres have been making headlines due to the scale and scope of the proposed projects. The focus of this article will be to describe what a data centre is and how the buildings and other improvements will be assessed for municipal property taxes.

The proposed large hyperscale facilities will include a warehouse type building with enhanced systems such as electrical, fire suppression, heating, venting and air conditioning. The function of the building is to protect the computer servers, storage arrays and networking gear located inside the building. The large hyperscale projects also include plans for power generation equipment to generate the electricity needed to run the computer systems inside the buildings.

The rules for assessing property are found in Part 9 of the Municipal Government Act (“MGA”). “Property” is a defined term and includes land and improvements to the land (s. 284(1)(r)). All “property” in the municipality must be assessed for municipal taxation each year (s. 285).

The term “improvement” is defined at s. 284(1)(j) as including:

- structures;

- any thing attached or secured to a structure, that would be transferred without special mention by a transfer or sale of the structure

- designated manufactured homes;

- linear property; and

- machinery and equipment.

The term “structure” is defined at s. 284(1)(u) to mean: “a building or other thing erected or placed in, on, over or under land, whether or not it is so affixed to the land as to become transferred without special mention by a transfer or sale of the land.”

Accordingly, each component of the data centre must be evaluated to determine whether it falls under the definition of “improvement” summarized above. If it does not fall under the definition of “improvement,” it cannot be assessed for municipal taxation purposes.

The building that houses the computer equipment would meet the definition of a “structure.” This would also include the electrical, fire suppression, heating, venting and air conditioning systems installed in the building. If the project includes power generation equipment, that equipment will be assessed as “linear property.”

The outstanding question is whether the computer equipment meets the definition of an “improvement.” It does not meet the definition of “linear property” or a “structure.” The computer equipment would likely not be considered “any thing attached or secured to a structure, that would be transferred without special mention by a transfer or sale of the structure”, because this requires a significant degree of affixation to the structure itself. In most cases, the computer equipment will be installed on racks and connected to those racks by being plugged in to a power supply. This would not be sufficient to affix the computer equipment to the building, meaning that it could not be assessed as something attached or secured to a structure.

The computer hardware located inside the building likely does not meet the definition of “machinery and equipment”, which is found at s. 2(1)(g) of the Matters Relating to Assessment and Taxation Regulation (“MRAT”). Under that definition, something can only be considered assessable “machinery and equipment” if it “forms an integral part of an operational unit intended for or used in”:

- manufacturing;

- processing;

- the production or transmission by pipeline of natural resources or products or by-products of that production, but not including a pipeline;

- the excavation or transportation of coal or oil sands;

- a telecommunications system; or

- an electric power system, other than a micro-generation generating unit.

It is unlikely that computers installed at a data centre would meet the above definition, because the computers would not form an integral part of an operational unit engaged in any of the functions listed above. The end result is that, in most cases, it is likely that the computer equipment would not be assessable for municipal taxation purposes under the MGA.

The land on which the data centre is built will be assessed at its market value. The building itself will be assessed at its market value. The linear property is assessed – although not at market value, it is assessed using a regulated formula.

If you would like to learn more about data centres and how they will be assessed for municipal property tax purposes, consider registering for the upcoming webinar being offered by the Alberta Assessors’ Association.

This post is meant to provide information only and is not intended to provide legal advice. Although every effort has been made to provide current and accurate information, changes to the law may cause the information in this post to be outdated.